What’s Required of the Executor of an Estate?

Being named as the executor of a friend’s or family member’s estate is generally an honor, but settling an estate can be a difficult and time-consuming job. Each state has specific laws detailing an executor’s responsibilities.

If you are asked to serve as an executor, you may want to research the legal requirements, the complexity of the estate, and the potential time commitment. You should also consider seeking the counsel of experienced legal and tax professionals. An executor generally has the right to be compensated for services and reimbursed for expenses; fees vary depending on the situation.

Typical duties

The executor of an estate (referred to as a personal representative in some states) is named in the deceased’s legal will. An executor typically must file a petition for probate, the legal process for establishing the validity of the will. Some estates may not require probate, depending on size, types of assets, and state laws. If there is no will, there is technically no executor, but the probate court will appoint an administrator or personal representative to carry out the same duties.

If the deceased created a letter of instruction, it should include much of the information needed to close out an estate, such as a list of documents and their locations, contacts for legal and financial professionals, a list of bills and creditors, login information for important online sites, and final wishes for burial or cremation and funeral or memorial services.

Where There’s a Will...

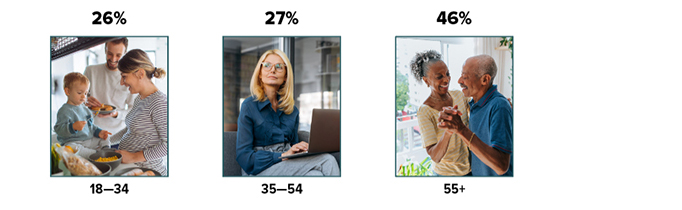

Almost two out of three Americans think it’s important to have an estate plan, but only one out of three actually has a will or other estate planning document. The most common reason for not having a will is simple procrastination. Not having a will can make it much more difficult to settle an estate.

Percentage of Americans with a will, by age group

Source: Caring.com, 2023

Here are some duties you might take on as an executor.

Arrange for funeral and burial costs to be paid from the estate. Collect multiple copies of the death certificate from the funeral home or coroner. They may be needed to fulfill official obligations, such as presenting the will to the court for probate, claiming life insurance proceeds, reporting the death to government agencies, and transferring ownership of financial accounts or property to the beneficiaries.

Handle any government benefits and file tax returns. The funeral home will typically notify the Social Security Administration. Federal benefits received after the date of death must be returned. However, Social Security benefits are paid a month behind, so a payment in the month of death for the previous month would not have to be returned. You may have to file final personal income tax returns for the deceased, estate income tax returns, and estate tax and gift tax returns if applicable.

Protect assets while the estate is being closed out. This might involve securing a vacant property; paying the mortgage, utility, and maintenance costs; changing the name of the insured on home and auto policies to the estate; and tracking investments.

Inventory, appraise, and liquidate valuable property. You may need to sort through a lifetime’s worth of personal belongings and list a home for sale.

Notify potential creditors and pay any debts or taxes. You may have to publish a notice to potential creditors, as directed by the probate court and state law. Debts such as medical bills, credit card balances, and taxes due should be paid out of the estate. The executor and/or heirs are not personally responsible for the debts of the deceased that exceed the value of the estate.

Distribute assets according to the estate documents. Proceeds from life insurance policies and retirement accounts generally go directly to named beneficiaries. You typically must wait until the end of the probate process to distribute remaining assets. Trust assets can usually be disbursed right away without court approval.

The executor has a fiduciary duty to act in the best interests of the estate and its beneficiaries. This means you could be held liable if estate funds are mismanaged and the beneficiaries suffer losses.

If for any reason you are not willing or able to perform the executor’s duties, you have a right to refuse the position. If no alternate is named in the will, an administrator will be appointed by the court.

by DB~001.jpg)